Research

Space Ventures Investors has over 10 years experience researching space, including start-ups, existing ventures, and equities. Our staff have over 50 years experience working in investment banking, finance, consulting, and follow many industry standards.

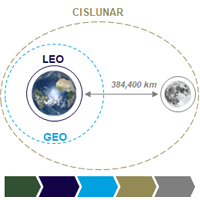

Our independent approach to researching space markets and technology has enabled us to pro-actively invest in emerging space companies developing the know-how and technology to compete in NewSpace and Space Resources; specifically Lunar resources exploration and extraction.

Read about our macro approach to space research on our Strategy page.

Below is freely available information, for more specific research, get in contact with us.