An Introduction to Space Ventures Investors

Our task is to find opportunities in the space sector by creating our own research, interpreting external research, to then invest independently, and deliver value and dividends to our shareholders.

For SVI opportunity presents itself based on capital that can be allocated to projects that have an edge. The space industry has established verticals, yet there are unique opportunities within those verticals, based on entrepreneurship, innovation, and the ability to fund projects to fruition.

SVI has conducted its own research for over 10 years. The goal is to find opportunities and to avoid overcrowded investments, including avoiding investments into facsimiles of existing companies that have already established and maintain a market position. As an example, SpaceX has a near monopoly on launch; there is little need for more newer launch companies, unless it serves sovereign nations directly.

For space investors, SVI offers a one-stop-shop solution. We source deals and opportunities. We filter out and filter in. We invest for the long term with the goal of paying dividends, including for the long-term; an investment in space mining in time, and if successful in mining on the Moon’s surface, leads to royalties, ideal as a passive income in the future.

Our story

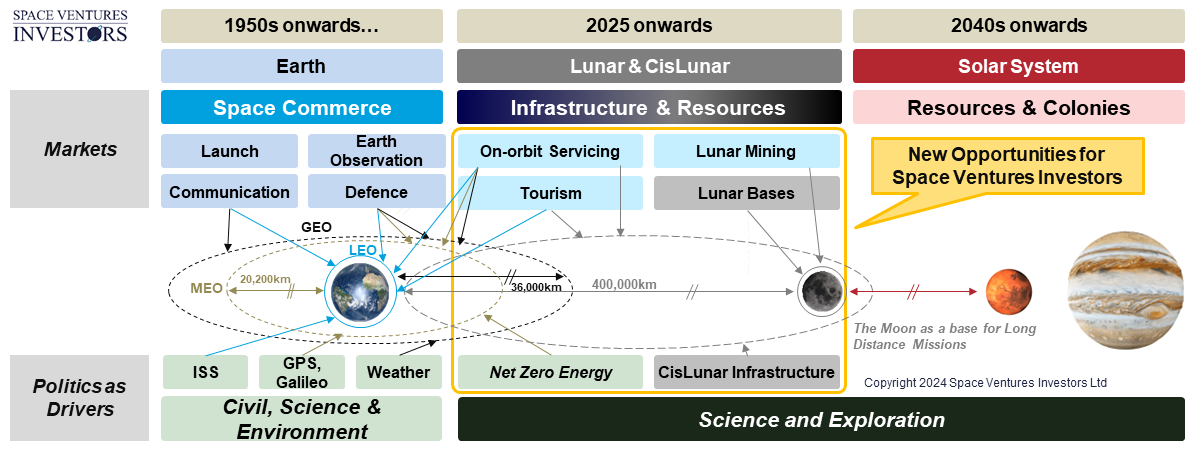

In previous decades, space missions were primarily operated by space agencies, yet private sector involvement was vital for supplying hardware and expertise. As commercial satellite operators, and recently SpaceX and Blue Origin (supported by billions of investments from their owners and governments (via contracts)) have become key players for implementing space-based infrastructure. The ‘high-cost barrier to entry’ to operate missions has been lowered. As the price per missions lowers the costs for ongoing commercial operations, the sector is then stable and profitable for a new wave of investors; from funds, to private equity, and retail investors.

Predicting this new investor demand, Space Ventures Investors Ltd (SVI) was established in 2014 by Simon Drake and Kevin Mac Gowan. They identified the potential of the next space race and how it will re-shape the global economy. Thanks to their experience from working in many global companies, including investment banking and marketing, combined with their sense of entrepreneurship and a passion for space, they started to work on the concept of making space a tangible investment for everyone. Thomas Lazaridis joined the team in 2015 prior to leading the investment arm of SVI. Adrian Kingsford joined in 2023.

The core vision of SVI is to allow both sophisticated and non-sophisticated investors to invest in space as a portfolio. SVI created a research tool to define the sector, the Strategic Space Value Chain; split into verticals, a visual framework showing existing and emerging companies that are integral to space commerce and space resources. By identifying each layer of the value chain, SVI has been able to target upcoming start-ups by categorizing them by sub-sector and identifying key industrial partners that would provide the support, and even exits, bringing value and financial returns to SVI’s investors.

SVI has successfully invested in multiple European and US start-ups. The goal is ongoing, to build start-ups, strengthen businesses, support visionary projects, and create the leaders of tomorrow. SVI’s own investors and entrepreneurs need each other, and SVI is the ideal vehicle: A shareholder driven company that follows a simple road map; the Strategic Space Value Chain, comprised of space start-ups and established companies. SVI is part of the value chain, also offering services such as management, capital raising, marketing, business development and project management.

SVI also monitors trends, to determine what is in vogue and where funding will be allocated to.

The role of markets, space agencies, governments, and sentiment; public and commercial

There can be no doubt that large space agencies, the governments that fund them, and the sentiment of the people that elect leaders of governments, direct space expenditure into activities that can have far reaching applications. As an example space agencies maintain solid, science specific, space exploration programmes based on the budgets they receive. Alternatively, the public need for global communications spurred the massive growth in the communications industry and their ability to launch and maintain communication satellites far out in geosynchronous orbit. Exploration and communication have been the core drivers of the space industry.

Recent public sentiment and commercial acumen has shifted.

Recently there has been a political drive for environmental action, as an example Net Zero; Space can play its part by providing a space based solar power solution.

On the commercial side, private space companies that have been developing space technology for human flight and planetary exploration missions can now leverage their experience to commercially sustainable space tourism and space resources operations. Recently, Starlink has taken mass market communication from a predominantly geo-synchronous orbit domain to low earth orbit.

SVI: A Sharper Focus on Space Resources

SVI sees game-changing and history altering opportunities in Space Resources, and more specifically Mining the Moon, or Lunar Resources Exploration and Extraction. SVI is already involved with several joint-ventures / spin-offs. The intention is to build on the vision of a Strategic Supply Chain from Earth to the Lunar Surface. Existing activities include:

Space Commodities Exchange: Intellectual Property development. The on-orbit servicing industry is just taking-off, and includes commodities sent from Earth, dispatched to LEO, GEO and Cislunar, for re-fuelling satellites, space craft, and supply manned space stations.

Lunar Resources Registry: The Lunar Resources industry is nascent, and we are already part of it. We have a front-row seat to the opportunity and a practical approach on how to achieve our most vital objective: To make Space Resources a commercial industry.

European Light Lunar Lander Joint Venture in Europe: In 2021 Berlin Space Consortium, Space Ventures Investors Ltd, and Lunar Resources Registry UG agreed to form a Joint Venture in Europe, to design, manufacture, launch and operate European Light Lunar Landers (ELLLa). ELLLa will conduct Lunar missions for its joint venture partners, host payloads, and sell landers to prospective clients.

To read more: Over 5 Years Participation in Space Resources Events

Below: Simon Drake presenting at a Space Commerce event.

A renewed interest in Space Stocks

Investing in space stocks including equities funds ETFs and SPACS, is based on cyclical factors.

Larger aerospace companies have space divisions, yet they are not what we would determine as pure space stocks. They can offer stability, dividends, and lead innovation, however usually at the behest of clients that are defence related or space agencies.

Since the early 2020s there has been a new wave of pure space stocks. They closely followed the NASDAQ, and then following a general market correction, have levelled out to what we would artfully determine as a better path to determine fair value; others would say many space SPACs have cratered, which is part of normal cleansing process.

SVI is not wholly concentrated on space stocks, yet there are times when an interesting company that is developing a new application (from software to hardware), fits into our concept of the Strategic Space Value Chain. When we do purchase shares in a space company we usually have a firm idea of entry and exit points.

To capitalise on the public interest in space stocks, SVI has created an independent website for research and monitoring of these companies: Space Stocks and Funds.