We are building the Intellectual Property required to evaluate and form Asteroid Mining Ventures

Step by Step, Asteroid Mining will happen, so how and when is our focus…

1. Asteroids as Science: The Adventurous Agencies Lead the Way

It is the space agencies that have led the way with a collection of missions that are designed to explore how we can one day harness and mine asteroids.

2. Asteroids as Commodities: Towards Unlocking the Abundance of Resources in our Solar System

Space Resources and In-Situ Resource Utilization are largely conceptual but the Supply-Chain of technology providers continues to evolve.

Asteroid Mining, first Prospecting, then Commercial Claims, then Extraction:

Asteroid Mining is a topic, that like Near Earth Asteroids / Objects dipping in and out of reach of Earth, comes into focus before slipping away again as it seems evidently out of reach. However, the premise of Asteroid Mining grows as the future market demand takes shape:

– Water is a pre-requisite for real space commerce, and

– In-Situ Resource Utilization of platinum group metals will enable an off-world economy to flourish.

Naturally from concept to implementation is decades away, yet there are compelling commercial business cases that precede Asteroid Mining, namely Asteroid Prospecting.

Commercial Asteroid Prospecting

Asteroid Prospecting is to leverage existing knowledge and academic partnerships to identify Asteroids that contain ice (water; hydrogen and oxygen) and metals that will intersect Earth’s orbit around the Sun, when the technology for advanced Asteroid prospecting is possible, e.g. using a constellation of specific spacecraft, followed by pre-liminary extraction operations; Water being the first priority.

At this stage, for Asteroid Mining, the business case is Asteroid Prospecting, and the value is the propriety information of which Asteroids to focus on, and then to establish a Commercial Mission to explore and extract.

An Overview of Agency Asteroid and Comet Missions

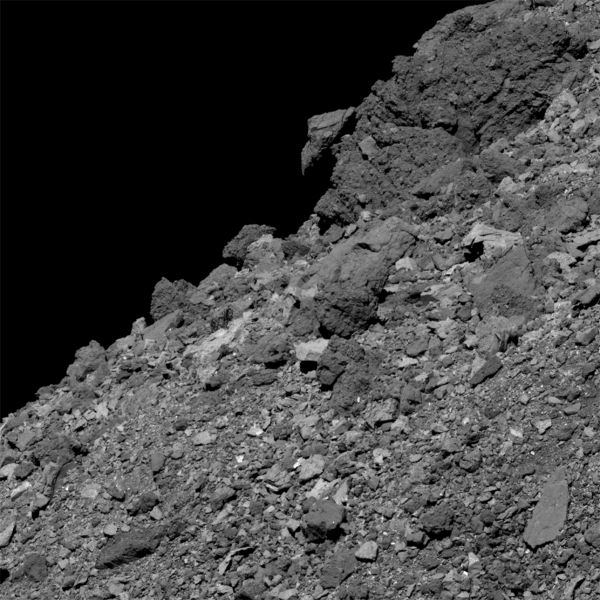

NASA Mission OSIRIS-REx. Asteroid Bennu’s boulder-covered surface. Credits: NASA/Goddard/University of Arizona

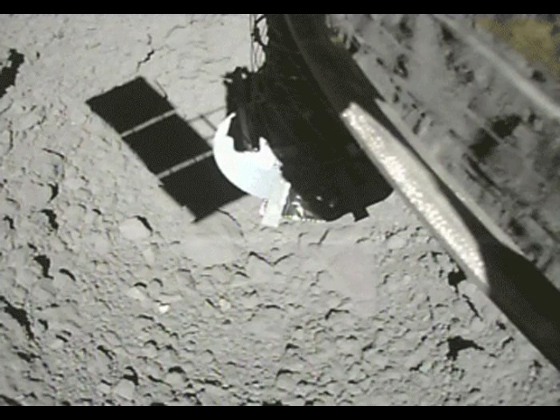

JAXA Mission Hayabusa2. Image from CAM-H, July 11, 2019 between 10:03:54 JST (onboard time) and 10:11:44 JST. Image taken at an altitude of about 8.5m. Credits: Copyright JAXA

ESA Mission Rosetta. Four-image NAVCAM mosaic of Comet 67P/Churyumov-Gerasimenko, using images taken on 19 September 2014 when Rosetta was 28.6 km from the comet. Credits: Copyright ESA/Rosetta/NAVCAM

Asteroid Mining

Asteroid Mining Business Model

Asteroid Mining has attracted noteworthy attention, from the media, venture capital, and grass-roots technological theorists on how best to execute an operation. Estimates range from 2030 to 250 as when operational asteroid miners will be proving their theories and technology to their financial backers.

More important than the technology and the capital required to send asteroid miners into space is the mandate to do so: Signs have been encouraging, the goals are quite clear and the objective realistic: Wwhy mine on earth when there an abundance of asteroids? The U.S. Artemis Accords has made progress in legally clearing the way.

Investing in Asteroid Mining is an important strategy for Space Ventures Investors, and our view on how and where to proceed is shaped in part by our own Strategic Space Value Chain and following moderate projections on how the business will evolve. Right now it is not an activity we can invest in 100%, as we are aleady invested in Moon Mining via our Lunar Resources Registry, however, there is increasing interest to get in wiht early adopters. For SVI, that also means getting in early on understanding the business model of extracting material from asteroids, which is based on two important and variables:

The Value on Earth

The value of material, as determined by their scarcity on earth, e.g. precious and rare metals, has to make an asteroid mining operation viable. However, if all the gold in the world (which would fit into a large house, and only increases 1% per annum due to its scarcity) where to be extracted from asteroids and eventually transported to earth, the price of gold on earth should theoretically halve, or worse fall further, due to the unknown quantity of gold in asteroids yet to be extracted.

Precious and rare metals will always have value in a technologically progressive world, and the eventual how and when of a pay-off (including an investor exit) needs to be key to any strategy to invest in proposed asteroid mining. There are many exotic minerals that have a high worth, yet the problems of finding and extracting them on earth might be just the same as in a hostile asteroid belt. There is also the substitute factor: Will solar always rely on silver? Will nuclear fuel asteroid mining ventures?

On a positive note, who dares wins: An agile first-mover operation with a clear directive (e.g. to corner the market on a particular set of minerals) has the advantage.

The Value in Space

The value of the material, as determined by their use in space, supporting space missions and space infrastructure, e.g. water and metals, is probably more interesting and feasible.

Disregarding lower launch costs when shipping material into space like water and energy, finding these resources in space makes sense. But to launch large scale asteroid reconnaissance missions, fund and man extraction and refining operations, lower launch costs are integral to funding and operations. Thankfully, SpaceX and Starship could be the game changers.

For space infrastructure, there is the required pay-off between hauling resources, energy and materials into space from earth, or going to an asteroid belt, locating, extracting and refining them. If not from an Asteroid belt, then a Near Earth Asteroid of sufficient value, and of coure close proximity.

The combination of fabrication in space and asteroid mining (that is extraction of minerals, refining and production in space) plus the use of automated systems like robotic personnel, offers the greatest value and use of space resources. Large ambitious space missions, like colonizing Mars or establishing a permanent base on the Moon, may have to bring their water with them: It is far easier to divert an icy asteroid than to pump precious water up from earth.

Funding Asteroid Mining

Following the principles of existing mining explorers, asteroid mining follows the same process: An Asteroid Mining Company attracts investor capital to search, locate, extract and return / despatch valuable material from asteroids. What is deemed valuable may change: precious metals, water, titanium, hydrogen or something yet to be identified.

The timeline of the operation will be at least a decade, and as technology improves, half that. The two biggest questions will be cash flow, and the changing value of the target resources as the operation progresses. Rising value increases investor appetite. Decreasing value could mothball an asteroid mining operation even after it has executed 90% of its goals, then in steps, in time, the next round of asteroid mining investors.

Asteroid Mining is an expensive, enterprising and exciting industry in its early infancy. It will attract investors because as part of any space portfolio, the risk is already factored in, and the rewards are definitely there - it is only a question of where and when.

Interestingly, two sayings from the past can offer guidance on this topic:

Who profited from Gold Rushes? The guy selling the shovels to the prospective gold miners made more than them.

Another is apparently from Mark Twain: “A gold mine is a hole in the ground with a liar at the top”.

Both of them hold vital clues about Asteroid Mining.

The space infrastructure business supporting the extraction of resources from asteroids will be profitable before the asteroid miners, who also must not promise a sky full of diamonds only to serve up comet dust.